Seri Pacific Hotel Kuala Lumpur Time. A hundred percent 100 exemption is given when there is no profit gain from the disposal of a property.

Transfer Of Shares In A Real Property Company Donovan Ho

Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5 RM8550 Youll pay the RPTG over the net chargeable gain.

. Individuals who are not Malaysian citizens will be subject to RPGT at the rate of 30 for a holding period up to 5 years and 5 for a holding period exceeding 5 years. 900am to 500pm Event Code. 1 Malaysian Citizens Permanent Residents Malaysian citizens andor permanent residents who sell their property within the first five years of acquiring it will be subject to.

An amount of RM10000-00 or 10 of the chargeable gain whichever is greater accruing to an individual. He is a licensed tax agent -. The basics and the advanced Date.

An exemption on gains when a property is transferred within the. In short you do not need to pay for RPGT when the disposal cost of your property. An amount of RM10000 or 10 of the chargeable gain whichever is greater accruing to an individual.

Real Property Gains Tax RPGT Rates RPGT rates differs according to disposer categories and holding period of chargeable asset. The following are the rates. That is the highest rate of the sliding scale of gains tax payable when a landed property is sold.

The disposer is devided into 3 parts of categories as per. If you owned the. Real Property Gains Tax.

REAL PROPERTY GAIN TAX The Real Property Gain Tax RPGT is a tax chargeable on the profit gained from the disposal of a propertys in Malaysia which is payable by a seller. Tax payable RPGT rate x net chargeable gain The RPGT rate imposed depends on the entity of the disposer whether a permanent resident individual citizen or company and the period of. RM100000 property gains RM10000 waiver RM90000 taxable gains RM90000 x 10 RPGT rate RM9000 RPGT chargeable This tax.

For example A man bought a piece of property in year 2000 at a value of RM500000. 11 January 2016 Venue. I would like to focus on the timing to file real property gains tax forms CKHT Forms for the disposal of immovable assets arising from conditional contracts.

Real Property Gains Tax 3 LAWS OF MALAYSIA Act 169 REAL PROPERTY GAINS TAX ACT 1976 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. New Companies Act to focus on better corporate governance The Edge August 8 to 14 2016 updated MH Law on Impact of Companies Bill 2015 to Entrepreneurs - BFM. 25 percent 24 percent from year of assessment ya 2016 special tax rates apply for companies resident in malaysia with an ordinary paid-up share capital of myr 25 million and below at the.

The tax is calculated as such. RPGTA was introduced on 7111975 to. Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976.

He has to pay gains tax at the rate of 30 of the gain. LAWS OF MALAYSIA Act 169 REAL PROPERTY GAINS TAX ACT 1976 An Act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real. 2016 real property gains tax malaysia wwwhasilgovmy lembaga hasil dalam negeri malaysia lhdnmr1316 introduction real property gains tax rpgt is charged on gains arising from the.

Gain accruing to an individual who is a citizen or a permanent resident in respect of. In the above example where your gain was RM250000 the RPGT payable would be RM 50000. The executor sold the property in 2006.

Real Property Gains Tax RPGT in Malaysia Real Property Gains Tax RPGT is a tax chargeable on the profit gained from the disposal of a property and is payable to the Inland Revenue. So if youre a Malaysian citizen and you sell a property after holding it for four years you would be liable to pay RPGT at 20 of the chargeable gain. Understanding How Real Property Gains Tax RPGT Applies to You in Malaysia 3 February 2016 by Lim Jo Yan and Mak Ka Wai RPGT is a tax chargeable on the profit gained.

Tax Institute of Malaysia CTIM and the International Fiscal Association IFA Netherlands. RM 50000 RM 250000 x 20.

Common Questions Answered For Expats Investing In Malaysian Property Mm2h

Capital Gains Tax In Malaysia Things You Need To Know

Capital Gains Tax In Malaysia Things You Need To Know

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Exemptions On Rpgt No Rpgt For Gains On Disposal Of Property Tax Updates Budget Business News

Newsletter 15 2018 Tax Cases Development Part Ii Page 002 Jpg

Taxation On Property Gain 2021 In Malaysia

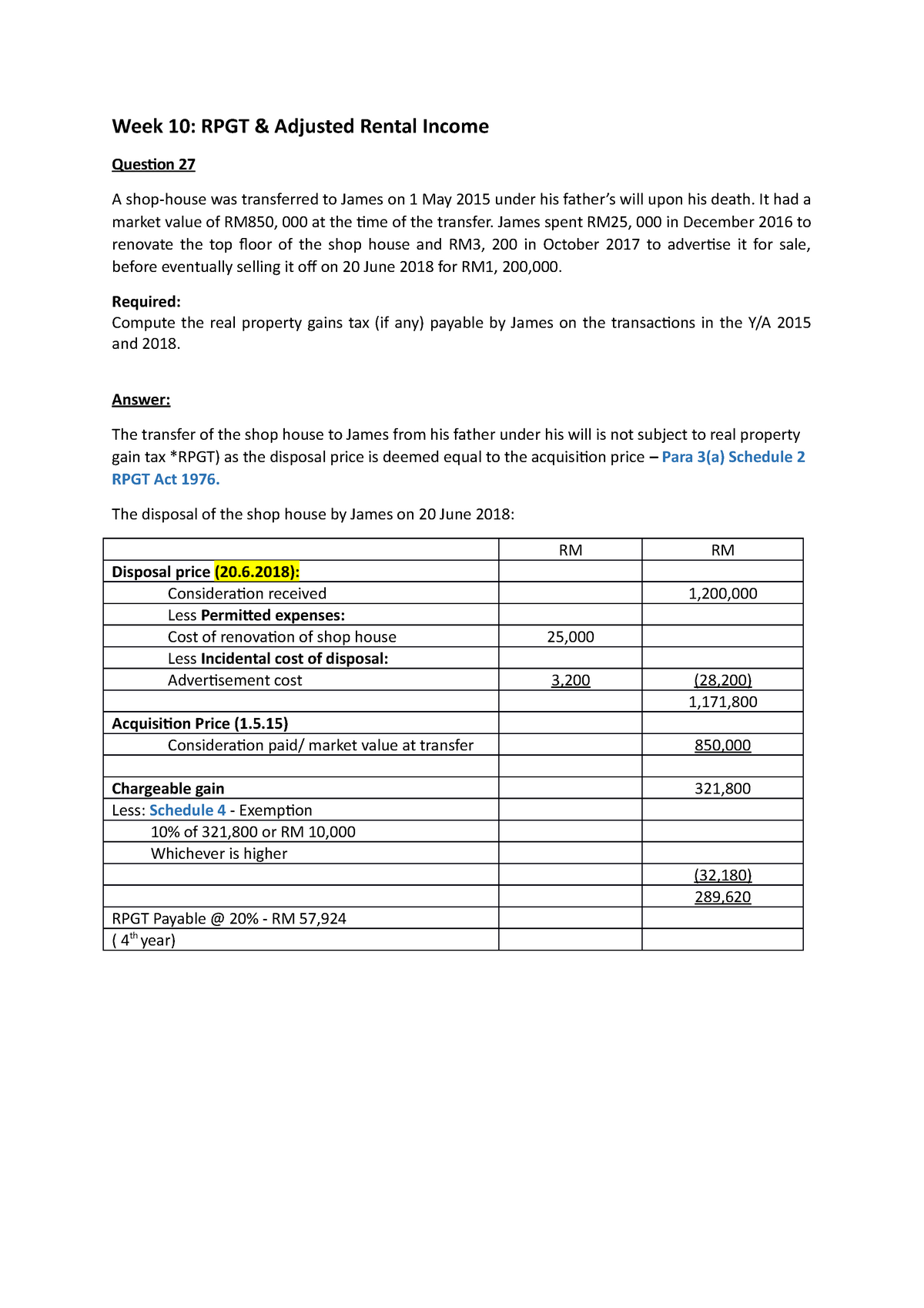

Rpgt Rpgt Answers Week 10 Rpgt Amp Adjusted Rental Income Question 27 A Shop House Was Studocu

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Real Property Gains Tax Rpgt Gl Property Consultancy Facebook

Taxation On Property Gain 2021 In Malaysia

Exellon Properties Malaysia Posts Facebook

Guidelines On Real Property Gains Tax Rpgt In Malaysia Wma Property

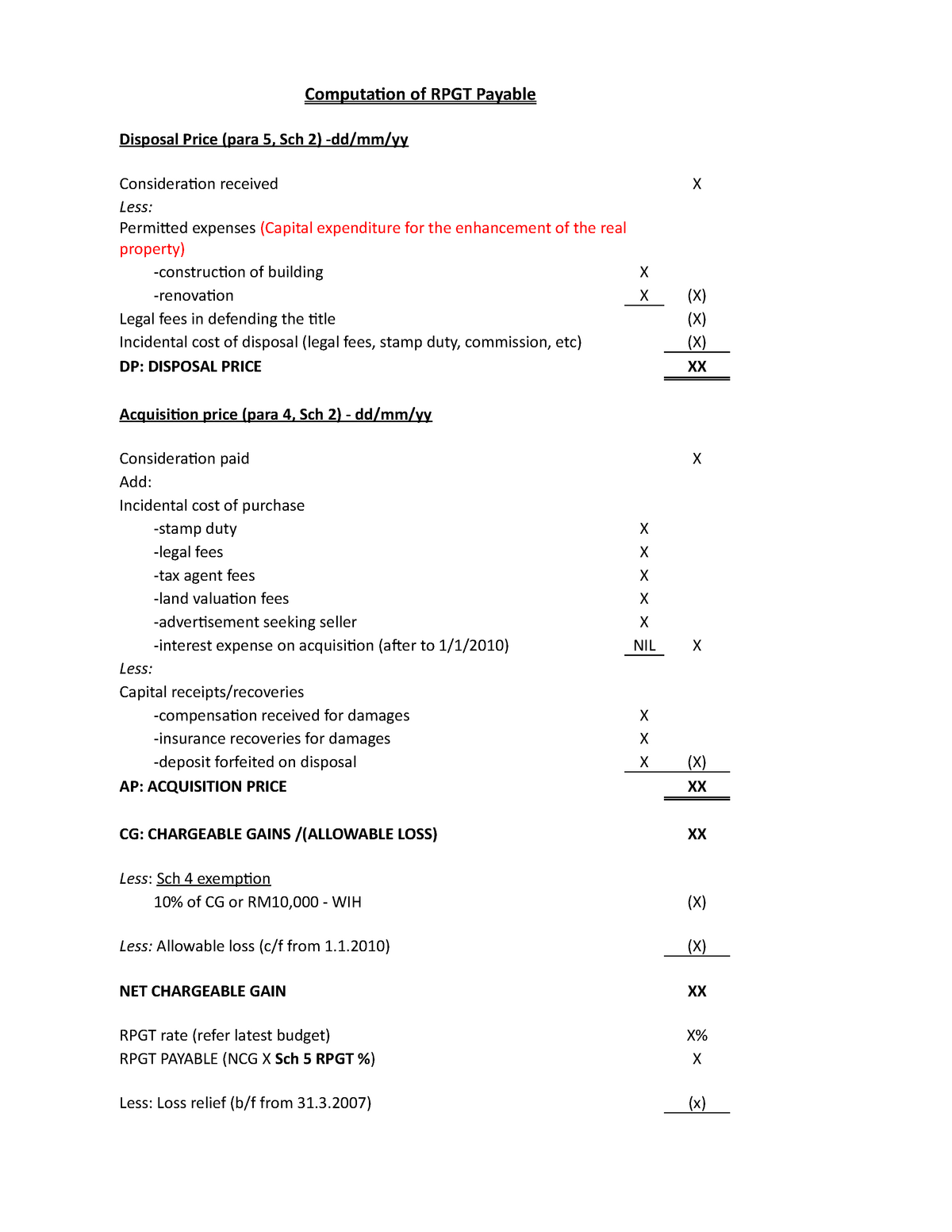

Format Of Rpgt Payable Revised Computation Of Rpgt Payable Disposal Price Para 5 Sch 2 Studocu

My Real Estate Portfolio Dividend Magic Real Estate Dividend Dividend Income

What Is Real Property Gains Tax The Malaysian Bar